Stuart R. Gallant, MD, PhD

On January 18, 2022, Microsoft announced a $68.7B purchase of the video gaming firm Activision Blizzard. This is a very interesting tale of negotiation for two reasons. First, in its SEC filing, Activision Blizzard gives us a peak into the negotiation that led to the sale. Second, as of the writing of this post, the purchase is not completed because it has not yet received regulatory approval. As a result, the deal could still be altered or even vetoed. In today’s post, DiscussingTerms looks at the Activision Blizzard acquisition.

Acquisition as a Negotiation

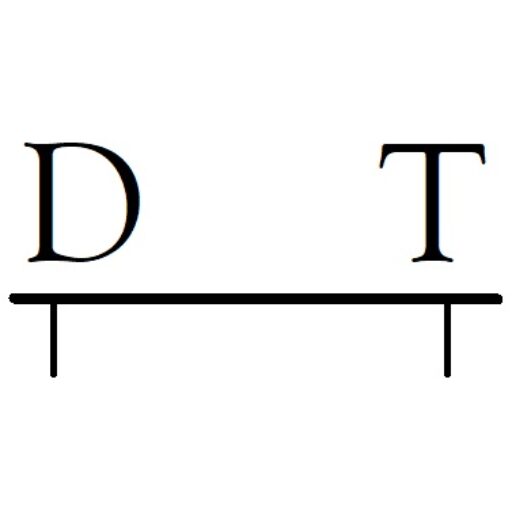

Acquisition is a two-party negotiation (buyer and seller). In the case of the Activision Blizzard, there are a number of parties not present at the negotiation table (stock holders, customers (users), and government regulators) who have the ability to affect the outcome of the deal. Most acquisitions are adversarial or competitive negotiations. Over time a zone of possible agreement is explored and, ultimately, a sale price established. Representation is common with one or both sides represented by firms specialized in mergers and acquisitions. (In the Activision Blizzard deal, Goldman Sachs provided financial advice to Microsoft, Allen & Company provided financial advice to Activision Blizzard, and Skadden provided legal advice to Microsoft.)

Activision Blizzard

Activision Blizzard is a company with many positive attributes. Leading characteristics making the company an attractive takeover target include:

- Intellectual property: Activision Blizzard’s stable of products includes some of the most well-known video games in the world: Call of Duty, Guitar Hero, World of Warcraft, Overwatch, Candy Crush Saga, and others.

- Worldwide appeal: Many cultural products have limited appeal around the world. Activision Blizzard video games have transcended their point of origin, capturing 370 million users in hundreds of countries.

But, the company has had two significant problems:

- Corporate culture: In July, 2021, the California Department of Fair Employment and Housing filed suit against the company, alleging sexual harassment and employment discrimination. The scandal acted as a drag on the company’s stock price as investors manifested concern whether the company’s management could navigate past the legal crisis.

- Competition: Activision Blizzard’s net revenue has grown in a steady linear fashion for more than 15 years, starting at about $1B in 2006 and reaching almost $9B in 2021. However, the video game market is tremendously competitive. As the third largest gaming company behind Tencent and Sony, Activision Blizzard faced major challenges, particularly in the areas of data analytics and machine learning.

Every corporation has two plans. Plan A is to grow the business. Plan B is to sell the business. The five common motivations for a sale of a business unit or a company are:

- To sell off non-core businesses

- To flip an asset (in the case of private equity)

- Insufficient capital to compete

- Business (particularly small or medium) in which some faction of the owners do not wish to continue to own the business—the classic family business sale

- Any business in which the current management team is not perceived to be able to maximize the value of the asset

Given the challenges faced by Activision Blizzard in the fall of 2021, the company fell into category 5). We will see how this situation developed into a negotiation for sale in the discussion below.

Microsoft

Since 2012, Microsoft has experienced exponential growth, a remarkable decade-long record of success:

Microsoft’s cloud services business Azure has played an important role in this growth. Though the tech sector, and the overall economy took a hit in 2022, growth is expected to continue once anxiety around inflation and concern about the situation in Eastern Europe subside.

The strategic question for Microsoft management is how can the company continue to fuel growth in the coming years? Management’s answer was the $68.7B acquisition of Activision Blizzard. The deal represents slightly less than 4% of Microsoft’s 2022 market capitalization. There are several strategic motivations behind the acquisition:

- Stock price: Activision Blizzard had led the 2022 fall off in tech stock prices by two quarters, making it an attractive acquisition target.

- Strategic technologies: Activision Blizzard intellectual property has driven consistent high revenue.

- Synergy and growth: Microsoft receives significant revenue from gaming. Addition of Activision Blizzard’s $9B net revenue from 190 countries will increase Microsoft in both breadth and depth. There is the possibility that the Activision Blizzard acquisition, coming on the heels of Microsoft’s acquisition of Bethesda Softworks, could lead to advances for Microsoft in the so-far ill-defined “metaverse,” allowing Microsoft to better compete versus Meta.

- Spoiling: By completing this acquisition, Microsoft prevents any of its competitors from obtaining this value for themselves.

This purchase does come with some significant risks:

- Large acquisition risk: Often large acquisitions underperform due to many complex and some poorly understood factors. Strategic fit and employee retention are two major factors that if not present can tank a large deal.

- Regulatory risk: Large corporate mergers and acquisitions are the subject of international regulatory interest. Regulators could demand that Microsoft alter some aspects of the deal or even scotch the entire acquisition.

Negotiation for the Sale

Negotiation of a sale is a highly ritualized activity. It begins with a Board of Directors decision to seek a sale, and proceeds through selection of an investment bank, preparation of supporting documentation, and development of a list of possible purchasers. This leads to an approach to possible purchasers, provision of an information memorandum, an offer expressed in a letter of intent (LOI), due diligence, contract negotiations, a purchase agreement, and closing.

Fortunately for us, some of the important details of the negotiation for the sale are included in a filing with the Securities and Exchange Commission supporting the sale [1]. It is worth noting that Activision Blizzard and Microsoft have worked together for decades on gaming, so it is not unusual that senior executives would be meeting at the time the story in the SEC filing begins:

- On November 19, 2021, Bobby Kotick, chief executive officer of Activision Blizzard, and Phil Spencer, the chief executive officer of Microsoft Gaming, were meeting (following a Wall Street Journal article three days earlier which had alleged that Kotick had known for years about sexual misconduct at his company—the WSJ article is not mentioned in the SEC filing, of course). One can imagine that the discussion between the two companies was probably tense following the WSJ article, given that the public scandal which had started over the summer of 2021 did not seem to be abating. In that meeting “Spencer raised that Microsoft was interested in discussing strategic opportunities between Activision Blizzard and Microsoft and asked whether it would be possible to have a call with Mr. Nadella the following day.” In this version of the story, Microsoft made the approach.

- On November 26, 2021, Microsoft made an all-cash offer of $80 per share. ATVI had opened the week at $60.62 which meant that the Microsoft offer contained a $20 premium. Activision Blizzard refused the offer, pointing out that the company had traded above $90 before the California DFEH suit. Activision Blizzard was essentially arguing that its pre-scandal stock price should be used as a comparable for its current valuation.

- On November 28, 2021, Activision Blizzard countered with a range of $90 to $105. I have always shied away from offering a range—it seems to me that by offering a range you are actually offering one number at the high or low end (depending on whether you are acting as buyer or seller). Initially, Microsoft attempted to apply this interpretation, accepting the range on November 29 while noting that it would be more comfortable at the low end.

- However, the range seems to have been a good negotiation strategy on the part of Activision Blizzard. Over the next two weeks, offers and counter offers at the ends of the range were exchanged. Just prior to December 16, 2021, Kotick informed Nadella that Activision’s floor was now $95, an offer which was ultimately accepted by Microsoft. In the end, the range became a device that allowed Activision to move the offer up from $90 to $95.

Looking through the SEC filing, it is fascinating to see the negotiation proceeding, almost as if one was a fly on the wall. But, the bargaining between Activision Blizzard and Microsoft was not the only action going on. In the SEC filing, it becomes clear that Activision Blizzard did have other suitors (referred to as “Company A,” “Company B,” up to “Company E” in the filing). It may have been the discussions with the other possible purchasers that gave Kotick the confidence to establish at $95 floor in mid-December.

Applying cash flow analysis, rather than comparables, the sale price of $68.7B seems reasonable. At $9B of net revenue annually (assuming that Microsoft only maintains revenue, rather than growing it) pays off the purchase price in a little over 7 years. Of course, Microsoft expects synergies to significantly grow the value of this purchase. Given that IT companies have historically been traded at valuations that cannot be justified by cash flow, this case is reassuring.

Regulatory Concerns

The Microsoft/Activision Blizzard deal is scheduled to close in 2023, provided that regulatory review proceeds successfully. The result of the acquisition would be a new Microsoft division Activision Blizzard to go with Microsoft’s Xbox Game Studios, both divisions to be housed inside Microsoft Gaming and headed by Phil Spencer.

For regulators, there is a significant amount of grist for their mill:

- Wages: Consolidation in the gaming industry represents fewer distinct workplaces and can depress wages for workers. Microsoft has attempted to be out front on this issue by promising not to interrupt unionization efforts at Activision Blizzard.

- Vertical Integration: Following Microsoft’s recent Bethesda Softworks acquisition, the games Starfield and Redfall were made exclusive to Xbox. Regulators have traditionally opposed this type of vertical integration in which an advantage in one area is used as a lever in another related area. These types of concerns harken back to the “bundling” of Internet Explorer with the Microsoft operating system which occurred in the 1990s and led to United States Justice Department Action

Numerous regulatory agencies around the world are looking at the acquisition, but it is the US Federal Trade Commission, along with the European Commission and the UK Competition and Markets Authority, that have the most power to block the deal. It was this combination of three agencies that prevented the $40B sale of the chip maker ARM from the Japanese SoftBank Group to the US software and chip maker Nvidia in 2022.

On December 8, 2022, the US Federal Trade Commission filed suit to stop the Activision Blizzard acquisition, citing the anti-competitive nature of the transaction. However, the suit is not a slam dunk. In the case of Nvidia, both ARM and Nvidia do business in the small area of chip manufacture. ARM intellectual property is used in Google, Microsoft, and Qualcomm chips. In contrast, Microsoft and Activision Blizzard operate in different business areas of gaming (hardware versus software)—so making charges of monopolization stick may be more difficult.

Microsoft began making moves in December to blunt some of the criticism of the deal—signing a deal to ensure that Call of Duty will be on Nintendo consoles for the next decade. At the current moment, it is unclear if the FTC has filed suit in order to go the distance in court or perhaps to increase its bargaining power and force concessions from Microsoft.

[1] Activision Blizzard, Inc. Schedule 14a filed with the United States Securities and Exchange Commission.

Disclaimer: DiscussingTermsTM provides commentary on topics related to negotiation. The content on this website does not constitute strategic, legal, or financial advice. Consult an appropriately skilled professional, such as a corporate board member, lawyer, or investment counselor, prior to undertaking any action related to the topics discussed on DiscussingTerms.com.